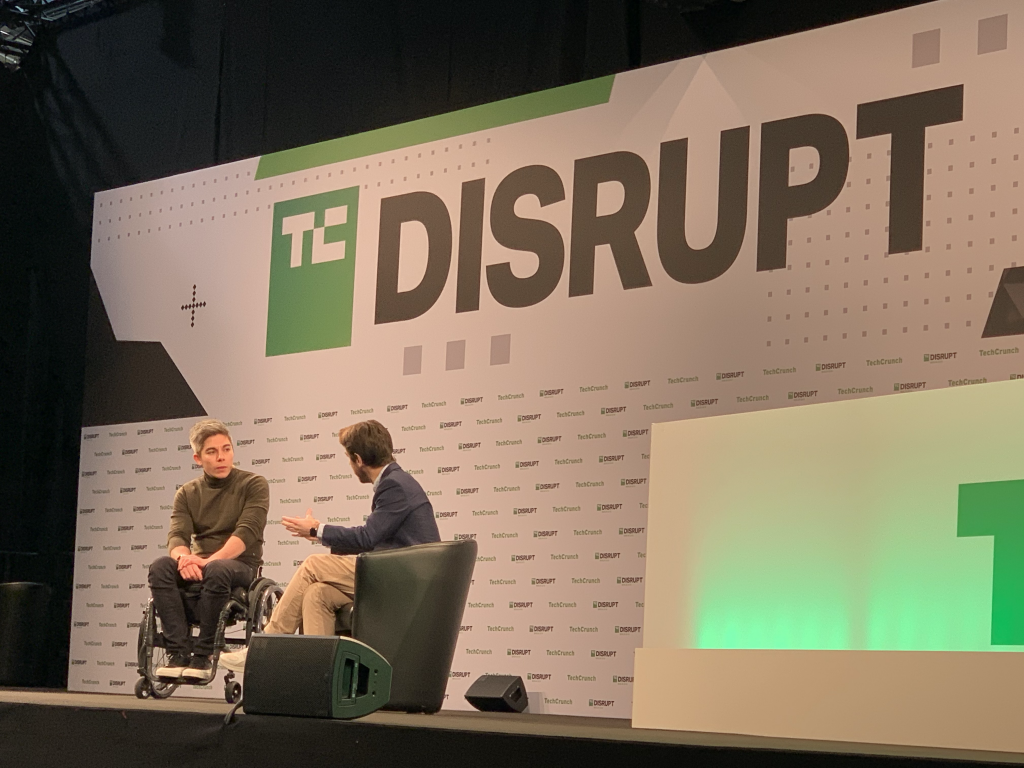

Interesting first person on stage at Techcrunch Disrupt: Hiroki Takeushi, co-founder of Gocardless.

He launched this service enabling Small and Middle Businesses to offer Direct Debit Payment.

Direct debit is quite different in every country. Gocardless connects all direct debit systems into one platform. Used to be UK focused. Now they can collect payments from dozens of countries.

Raised 27 million dollars recently, 50.000 B2B customers.

Quite ambitious plan to become the “visa of direct debit”.

Unfortunately Hiroki had a bike accident 3 years which left him unable to use his legs and needs to move with a wheelchair. Despite this challenge, the company continued to thrive, and actually it may have helped the founder to better delegate and focus on the most important decisions to be taken.

This company reminds me of how important direct debit has been for the former company I worked for as marketing director: StayFriends.de. A few years ago, we already had noticed that direct debit was a fantastic way to propose recurring payment in Europe, much better than credit cards that expire every few years. Interesting to see that Gocardless also sees that end customers don’t have a problem sharing their bank account data compared to their credit card data.

Recently, partnership Transferwise, which helps manage the currency issue. Enables to better collect money from customers all around the world and deal with the complexity of the currency variety / exchange rates.

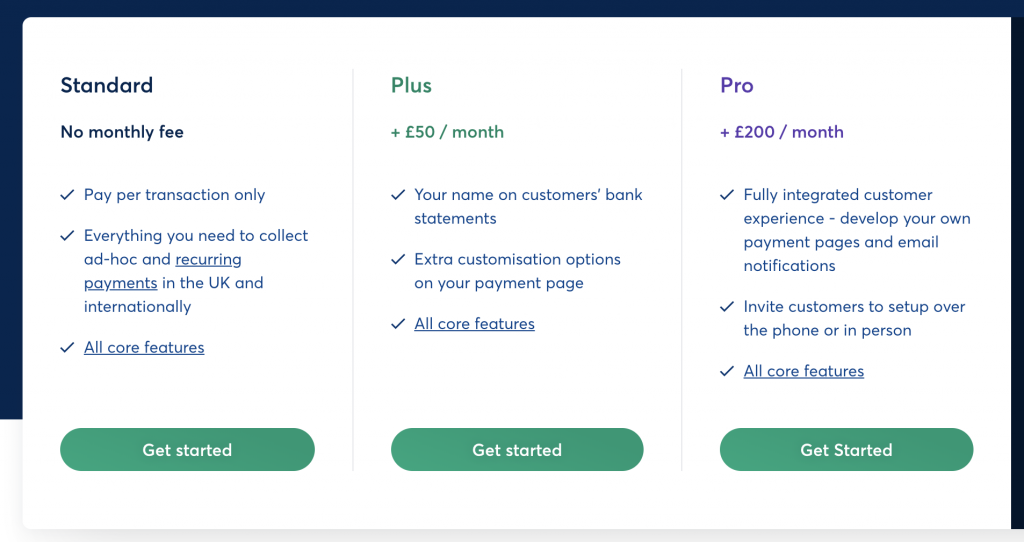

Pricing structure of Gocardless.com is also quite nice:

But what about the competitors like Paypal, Stripe or Adyen?

Differenciation for Gocardless: the competitors focus on merging retail and ecommerce, point of sale and online. But Gocardless is 100% focus on recurring payments and direct debit.